Providing essential auxiliary services to you and your tax accountant to capture specific credits and incentives

Accelerate property depreciation with our expert cost segregation studies and audit guarantee.

Claim federal tax deductions and credits for energy-efficient buildings and homes.

IRC Code Section 45L offers tax credits for energy-efficient residential construction or renovation projects.

Companies investing in R&D for products, processes, or software may qualify for a powerful business credit.

With over 25 years of experience preparing returns and advising clients on tax strategies, I consistently noticed several valuable strategies were overlooked. This was mainly due to the in-depth analysis and knowledge needed to capture these incentives. I saw a need to provide this niche service to other CPAs so their clients could capture these incentives without them spending additional time to make this happen.

Let us partner with you and your tax preparer to bring the power of these incentives to your wallet. Reach out today for a free 15-minute consultation to discuss your opportunities to capture these incentives.

• integrity through transparent and ethical practices,

• a client-centric approach to meet your specific needs, and

• a commitment to accuracy in every detail

Our Tax Services

Meet with us and we can help you reduce or eliminate your tax liability.

Posted onTrustindex verifies that the original source of the review is Google. On short notice, Dawn Polin of Envision readily embraced our company's last minute assignment of a complex, critical analysis of multiple properties and produced the most professional results within the promised time. She was also a pleasure to deal with, always responsive, amicably led our internal team, and, most importantly, enabled us to save significant money. I hope we have the opportunity to engage her firm again.Posted onTrustindex verifies that the original source of the review is Google. Dawn is amazing! Very professional and knows her stuff. Great return on investment.Posted onTrustindex verifies that the original source of the review is Google. I worked with Dawn for almost 5 years and learned so much from her. She will go above and beyond to help out clients. I would highly recommend her!Posted onTrustindex verifies that the original source of the review is Google. Dawn is very knowledgeable and really great to work with. She has great ideas to get the work done efficiently and timely.Posted onTrustindex verifies that the original source of the review is Google. Dawn is the go-to person to increase cash flow in a business that owns commercial buildings and vacation rentals. She knows how to use the tax code to decrease costs! What business owner doesn't love that?Posted onTrustindex verifies that the original source of the review is Google. I have known Dawn Polin since 2005 and used her CPA services starting in 2009. She is very courteous, helpful, and honest, plus she has great attention to detail. I highly recommend her!

Cost Segregation is a tax strategy that accelerates depreciation deductions by identifying and reclassifying portions of real property to shorter depreciation periods, typically 5, 7, or 15 years. A cost segregation “study” is a report that reverse engineers a building on paper assigning a portion of the purchase or construction cost to each component. Once this process is complete, the study concludes by summing the components that are allowed to be depreciated more rapidly.

Property owners who have constructed, purchased, or renovated any type of real estate can benefit. This includes residential rentals! To maximize the savings from cost segregation you should plan to hold the property in your portfolio for at least a few years.

We conduct a fully-detailed engineering study to identify and reclassify assets. These assets are then assigned to shorter depreciation lives, allowing for accelerated depreciation deductions.

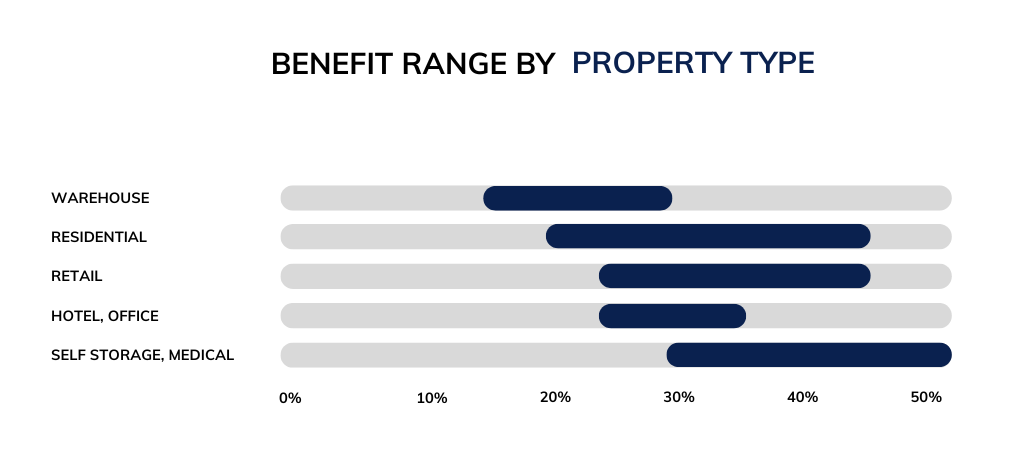

Almost any property used for business purposes can benefit, including apartment buildings, offices, shopping centers, manufacturing facilities, self-storage, residential rentals, STR properties and more.

Yes, Cost Segregation can be applied retroactively by filing a Form 3115, Change in Accounting Method, with the IRS. Our studies include this form, completed in its entirety, at no additional fee.

Section 179D is a tax deduction for energy-efficient commercial buildings, allowing owners or designers of such buildings to claim a deduction for installing energy-efficient systems.

Owners of commercial buildings and certain residential buildings over four stories are eligible. Designers (architects, engineers, contractors) of energy-efficient systems of government-owned or non-profit owned buildings can also claim the deduction.

The maximum deduction is $5.65 per square foot of the building, depending on the level of energy efficiency achieved and if the building paid prevailing wages to all of the contractors and subcontractors during construction.

Improvements to lighting systems, HVAC (heating, ventilation, and air conditioning) systems, and the building envelope (insulation, windows, etc.) can qualify.

The building must achieve a certain level of energy efficiency compared to a reference building defined by ASHRAE (American Society of Heating, Refrigerating and Air-Conditioning Engineers) standards. A certified third-party professional must conduct an energy analysis and provide certification.

Section 45L is a federal tax credit for energy-efficient residential buildings, providing incentives for builders and developers to construct energy-efficient homes and dwelling units.

Eligible taxpayers include builders, developers, and contractors who construct or significantly renovate energy-efficient residential properties, including single-family homes, multi-family buildings, and certain residential rental properties.

The credit is between $500 and $5,000 per dwelling unit for homes that meet specific energy efficiency standards and/or pay prevailing wages and meet apprenticeship program requirements.

The property must be certified to achieve at least 50% energy savings for heating and cooling over a comparable dwelling unit constructed in accordance with the applicable International Energy Conservation Code (IECC). At least one-fifth of the energy savings must come from building envelope improvements.

A certified third-party professional, such as a RESNET (Residential Energy Services Network) rater, must conduct an energy analysis and provide certification that the property meets the required standards.

The R&D Tax Credit is a federal incentive designed to encourage businesses to invest in research and development activities by providing a tax credit for qualified expenses to help offset the cost of moving science forward.

Businesses of all sizes and across various industries that engage in qualifying R&D activities can be eligible, including manufacturing, software development, pharmaceuticals, and more.

Activities that qualify include those intended to develop or improve products, processes, techniques, formulas, inventions, or software. These activities must involve a process of experimentation and meet the IRS's four-part test.

- Permitted Purpose: The activity aims to create or improve a product or process.

- Elimination of Uncertainty: The activity aims to resolve technical uncertainty.

- Process of Experimentation: The activity involves a systematic process of experimentation and evaluation of alternatives.

- Technological in Nature: The activity relies on principles of physical or biological sciences, engineering, or computer science.

Qualified expenses include wages for employees involved in R&D, costs of supplies used in R&D, costs of contract research, and certain costs associated with the use of computer systems.

Schedule a free consultation with a specialty tax expert. We’ll discuss your eligibility, your potential estimate of benefits and answer any questions you have.

DO YOU HAVE QUESTIONS?

Dedicated tax planning experts committed to optimizing your financial future.

Copyright © 2025 CRE tax planning, All rights reserved. Present by Click To Design Studio.